FXEM - EMPIRE MARKETS - Company New Article

To access the website's classic version and the new accounts, please click here

Jun 23, 2025

|

|

|

|

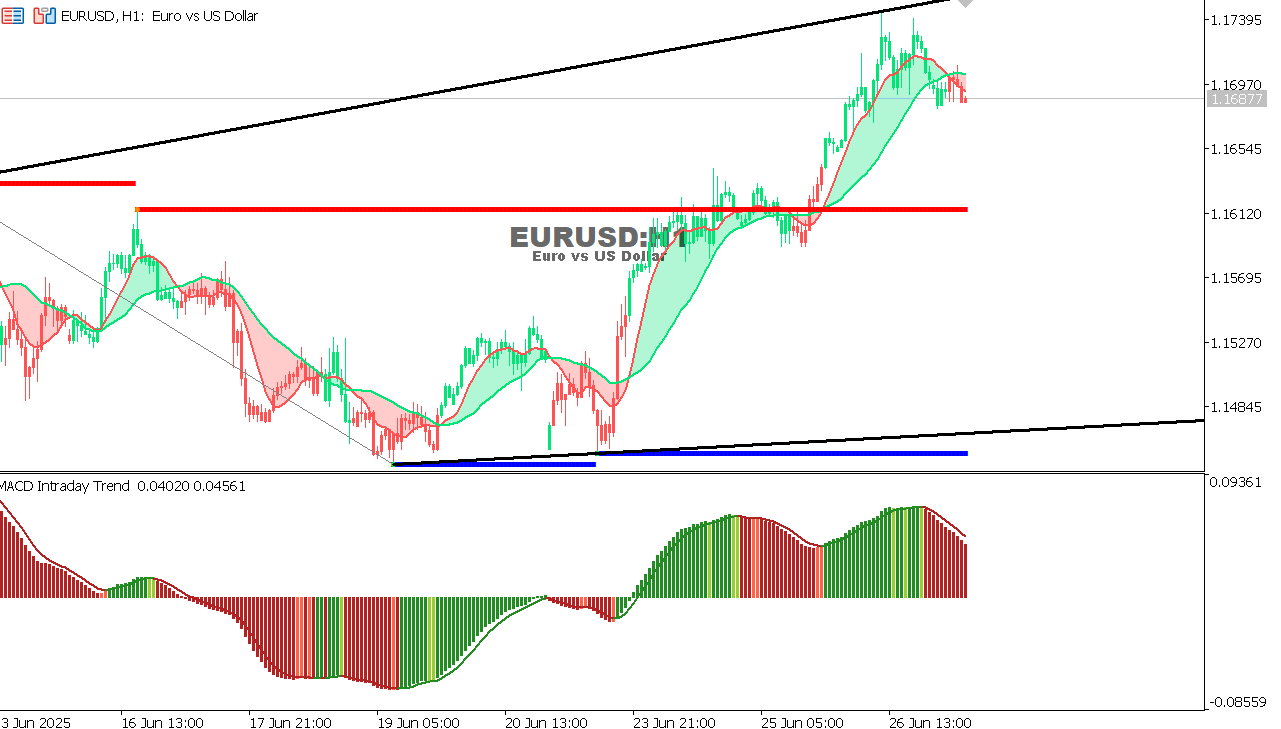

EUR/USD Chart on the hourtly time frameThe first support area was achieved at 1.1480.

Expectation: As long as the price is above the sloping support at 1.1450, there is a possibility of a rise to test 1.1550 again. A break of 1.1440 could change the short-term trend to a downside one. |

|

|

|