FXEM - EMPIRE MARKETS - Social Trading

To access the website's classic version and the new accounts, please click here

What is meant by Social Trading?

Social trading is a form of investing that allows investors to observe the trading behavior of their peers and expert traders. The primary objective is to follow their investment strategies using copy trading or mirror trading.

The Social Trading solution is designed to provide trade copying functionality.

The goals of this solution are:

- To copy trades from a source account into a target account.

- To establish the environment for the traders to register in copying schemes and configure them.

- To give the broker full control over their traders’ copying activity.

What is the concept of Social Trading?

The concept of Social Trading is to allow successful traders to share their trading strategies with less experienced traders (Followers) in exchange for a percent of the profit generated by following the strategy.

How does it work with FXEM?

Social trading is an online trading that allows traders to connect and share information, strategies, and insights on investment decisions. The main aim of social trading is to help traders improve their trading performance and make more profitable trades by connecting with other traders and sharing information.

Currently, the supported trading platform is MetaTrader 5.

What are the features of Social Trading?

Copy Trading:

- Auto-Copying: Social trading platforms allow users to automatically replicate the trades of selected investors in real-time.

- Copy Ratio: Users can decide the percentage of their funds to allocate for copying, giving them control over risk management.

Community Interaction:

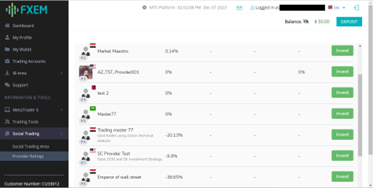

- Profiles and Bios: Traders have profiles showcasing their trading history, strategies, and performance.

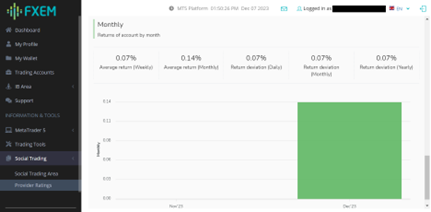

Performance Metrics:

- Historical Performance Data: Detailed statistics on traders' historical performance, including returns, risk metrics, and trade history.

- Risk Ratings: Traders often receive risk ratings, helping followers assess the level of risk associated with copying their trades.

Diversification:

- Access to Various Markets: Social trading platforms typically cover a range of financial markets, allowing users to diversify their portfolios.

- Follow Multiple Traders: Investors can follow and copy multiple traders to diversify their risk exposure.

What are the benefits for Social Trading?

Social trading offers several benefits to both experienced traders and individuals who may be new to financial markets.

- Beginners can learn from the trading strategies, insights, and experiences of seasoned and successful traders.

- Users can automatically replicate the trades of experienced traders, eliminating the need for active market monitoring.

- Social trading allows users to diversify their investment portfolios by following multiple traders who specialize in different assets or trading styles.

- Social trading allows individuals to benefit from the expertise of others without having to dedicate extensive time to market research and analysis.

- Users can make more informed investment decisions by reviewing the historical performance, risk metrics, and strategies of experienced traders.

- Social trading allows users to allocate a specific percentage of their funds to replicate the trades of others, giving them control over their risk exposure.

- Social trading eliminates emotional decision-making, as trades are executed automatically based on the actions of selected traders.

Types of Social Trading?

-

Individual Trading: Novice traders execute a single standard trade based solely on the recommendations or actions of an experienced trader.

-

Market Copy: Less experienced traders mimic the exact trading behavior of an experienced trader, engaging in several operations according to the same strategies.

-

Portfolio Copy: Novice traders replicate the complete portfolio of an experienced trader. In this scenario, the experienced trader earns a portion of the profits generated by the applied strategies.

-

Mirror Trading: Less experienced traders automatically mirror all the trades executed by an experienced trader, faithfully following every aspect of their trading activity.

Following a Trader

Similar to other social media platforms, you have the option to track a trader if you find value in their insights or believe in the accuracy of their predictions.

By doing so, you gain continuous access to their actions, comments, and ideas. This feature is particularly beneficial for novice traders as it enables them to learn from seasoned individuals and seek clarification on the rationale behind specific actions. It is advisable to follow experienced traders who actively engage with their community and are open to answering questions.

Is Social Trading for everyone?

Social trading isn't suitable for everyone. While it has been commended for breaking down barriers to financial inclusion, it has also faced criticism for minimizing the knowledge required for navigating financial markets effectively.

A common mistake made by social traders is assuming that this method eliminates risk entirely. In reality, all trading involves risk, and losses are inevitable at times. Relying on the judgment of a third party while retaining the full risk of potential losses is considered a significant drawback of social trading.

Successful engagement in financial markets demands knowledge and patience. Although social trading may offer a shortcut, it does so at the expense of gaining firsthand experience. It is crucial to ensure a thorough understanding of the process and implement an effective risk management strategy.

When entering the realm of social trading, you adopt someone else's trading plan. However, a trading plan should be tailored to your unique goals. While the strategies of others can provide guidance, their plans are designed for their specific objectives, motivations, and risk appetites. Since everyone has different financial capacities and risk tolerances, emulating someone else's trading style may not always be advisable.