FXEM - EMPIRE MARKETS - Company New Article

To access the website's classic version and the new accounts, please click here

Jun 23, 2025

|

|

|

|

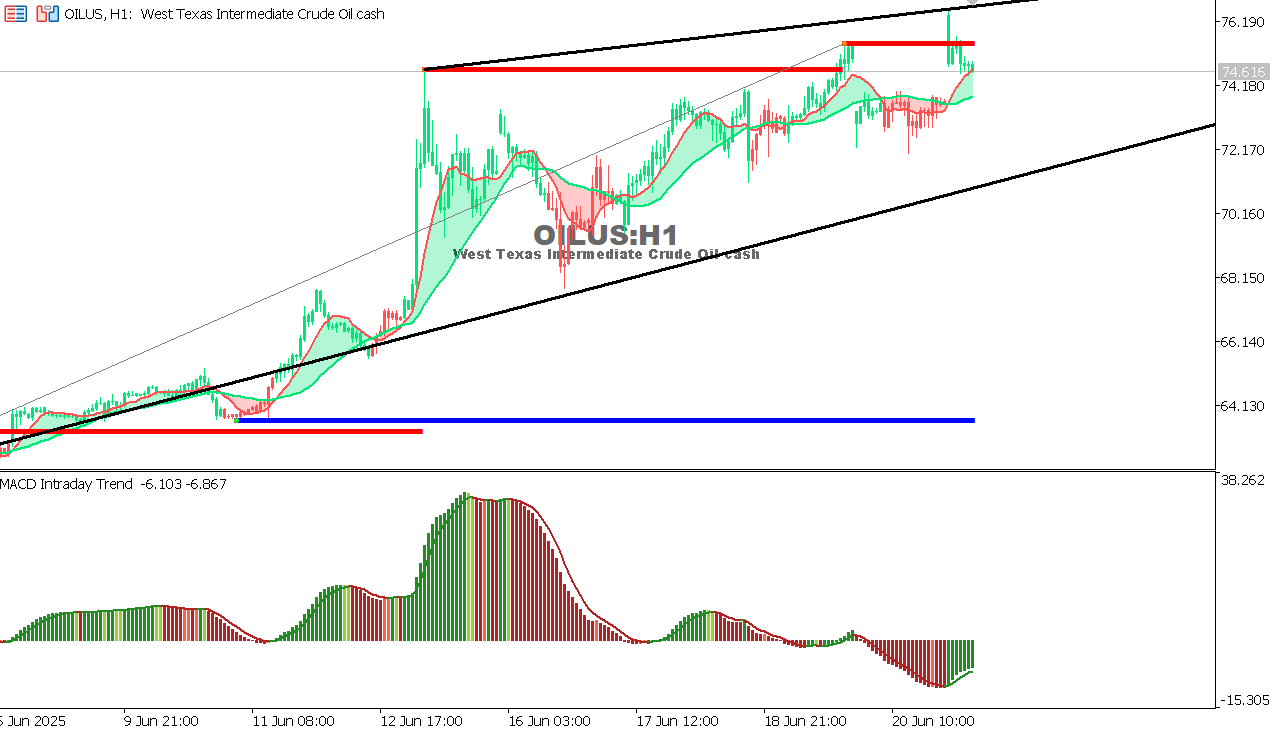

USOIL Chart on the hourtly time frame

Expectation: Continuation of movement within the ascending channel, and a break of 76.00 could open the way towards 77.80. A break of 73.30 temporarily negates the bullish scenario. |

|

|

|

|

|

|