FXEM - EMPIRE MARKETS - Company New Article

To access the website's classic version and the new accounts, please click here

Jun 20, 2025

|

|

|

|

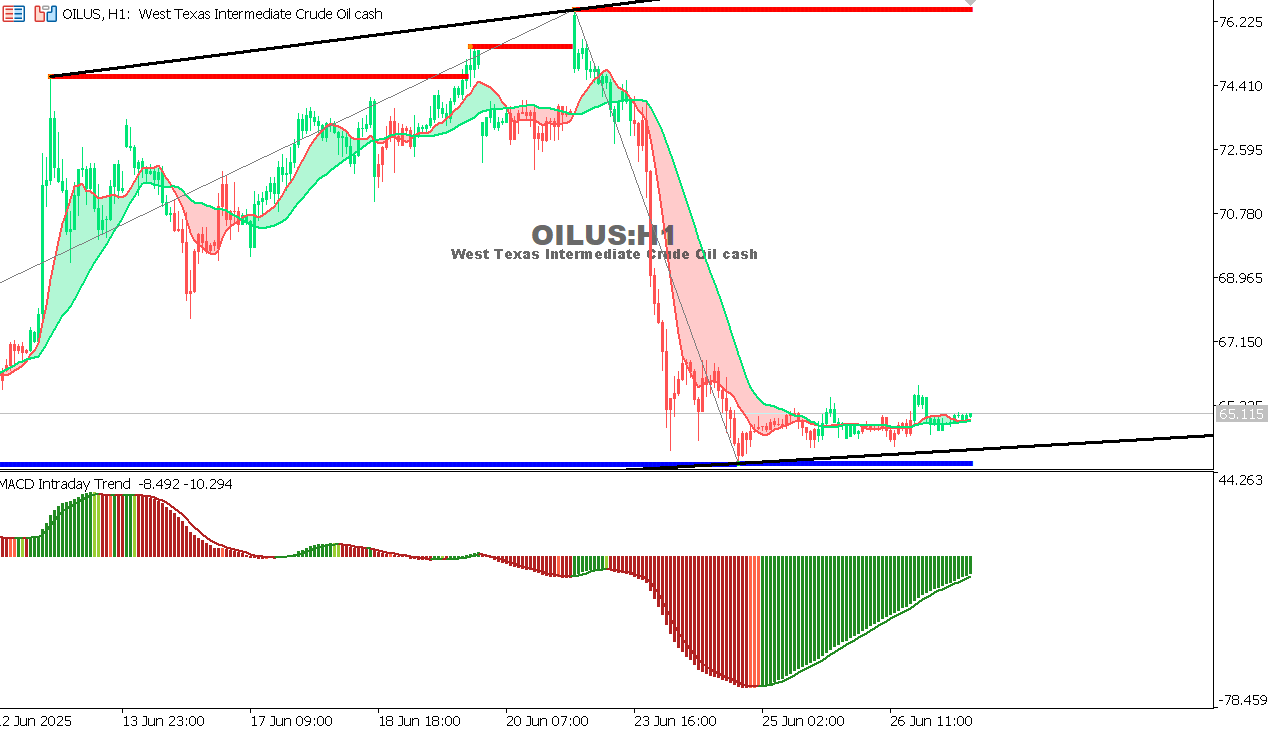

USOIL Chart on the hourtly time frameCurrent trend: Bullish within a symmetrical triangle.

Technical indicators:

Technical forecast:

|

|

|

|