FXEM - EMPIRE MARKETS - Company New Article

To access the website's classic version and the new accounts, please click here

Jun 17, 2025

|

|

|

|

||

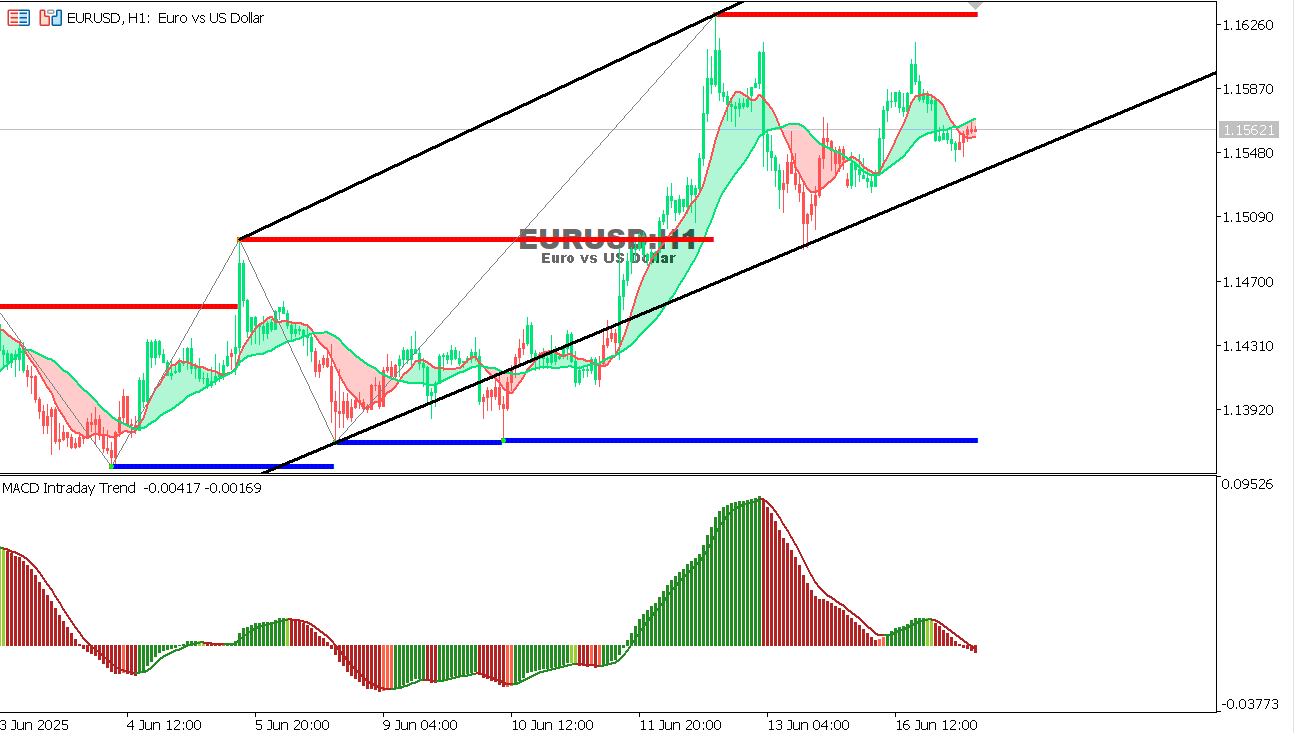

EUR/USD Chart on the hourtly time frameAs we predicted yesterday, there is a potential rebound from 1.1500 towards 1.1580 - 1.1600. The targets have indeed been achieved, and the pair is trading within a clear ascending channel and is currently approaching a strong resistance area at 1.1620, with signs of weakness in the upward momentum.

Expectations:

|