FXEM - EMPIRE MARKETS - Company New Article

To access the website's classic version and the new accounts, please click here

Jul 15, 2025

|

|

|

|

||

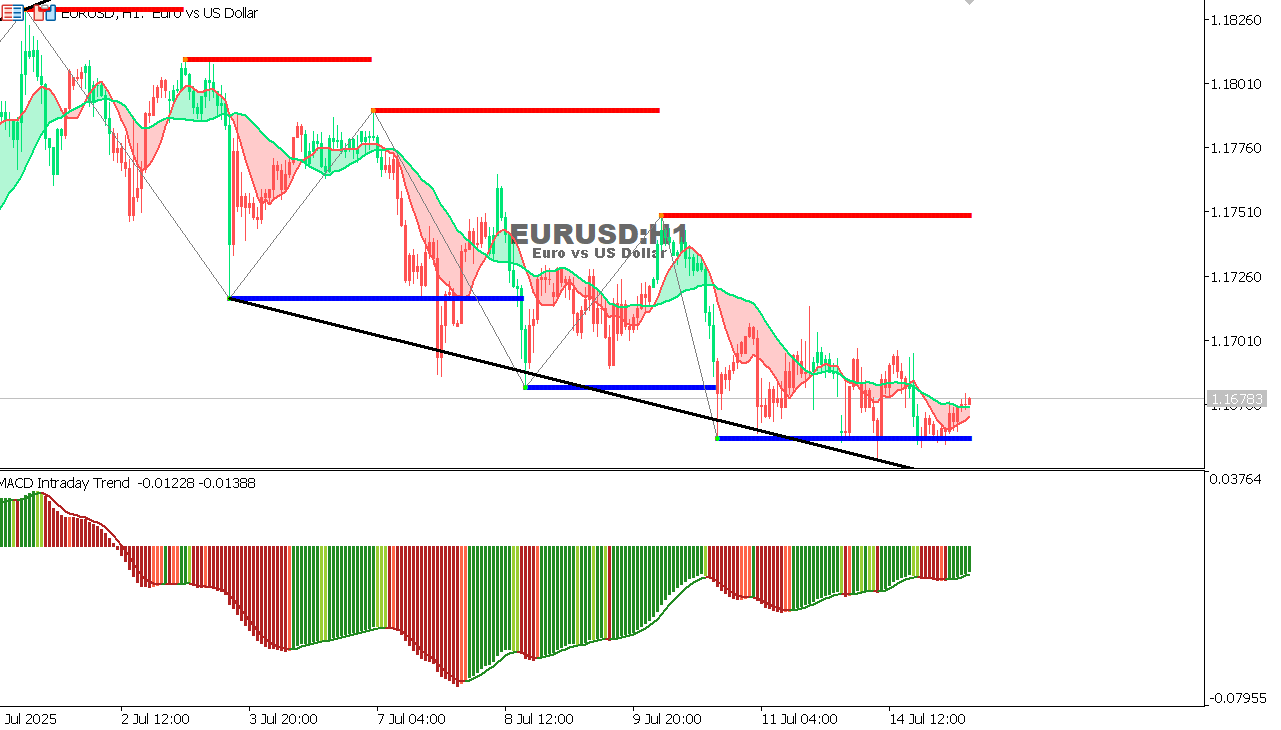

EUR/USD Chart on the hourtly time frame

Forecast:

|

To access the website's classic version and the new accounts, please click here

Jul 15, 2025

|

|

|

|

||

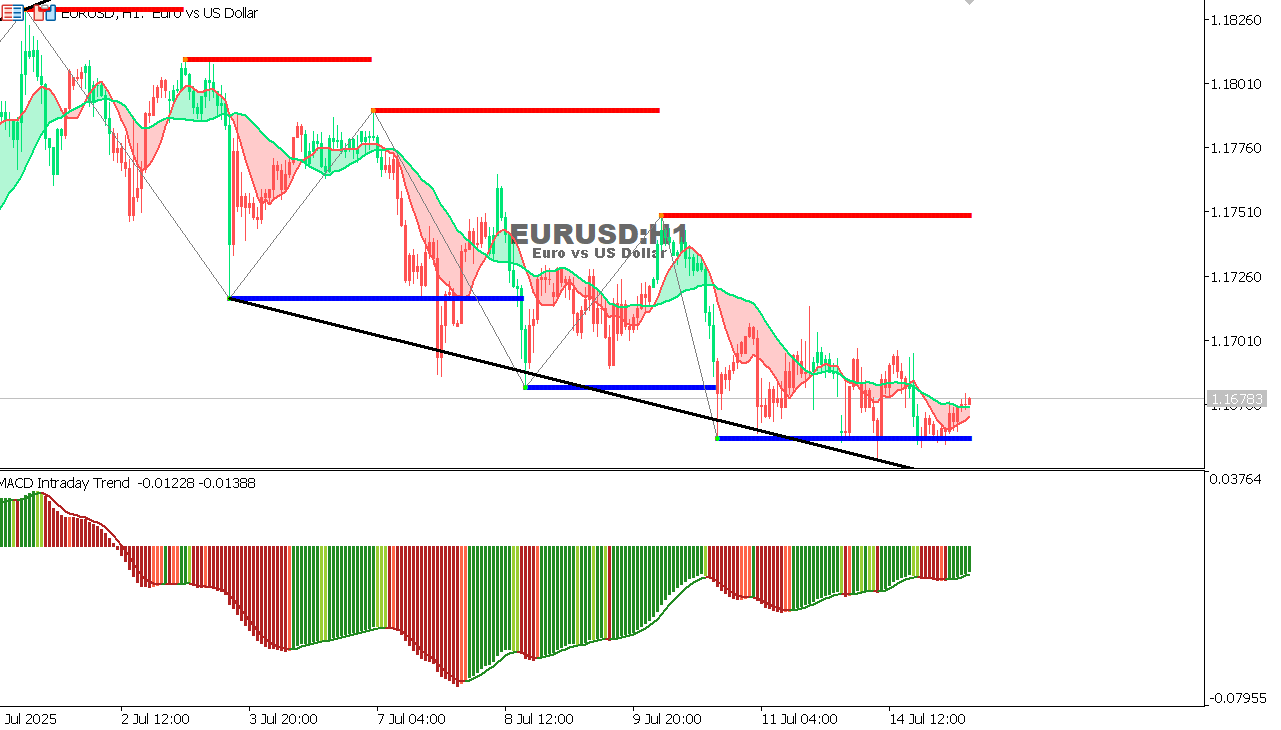

EUR/USD Chart on the hourtly time frame

Forecast:

|