FXEM - EMPIRE MARKETS - Company New Article

To access the website's classic version and the new accounts, please click here

Jun 16, 2025

|

|

|

|

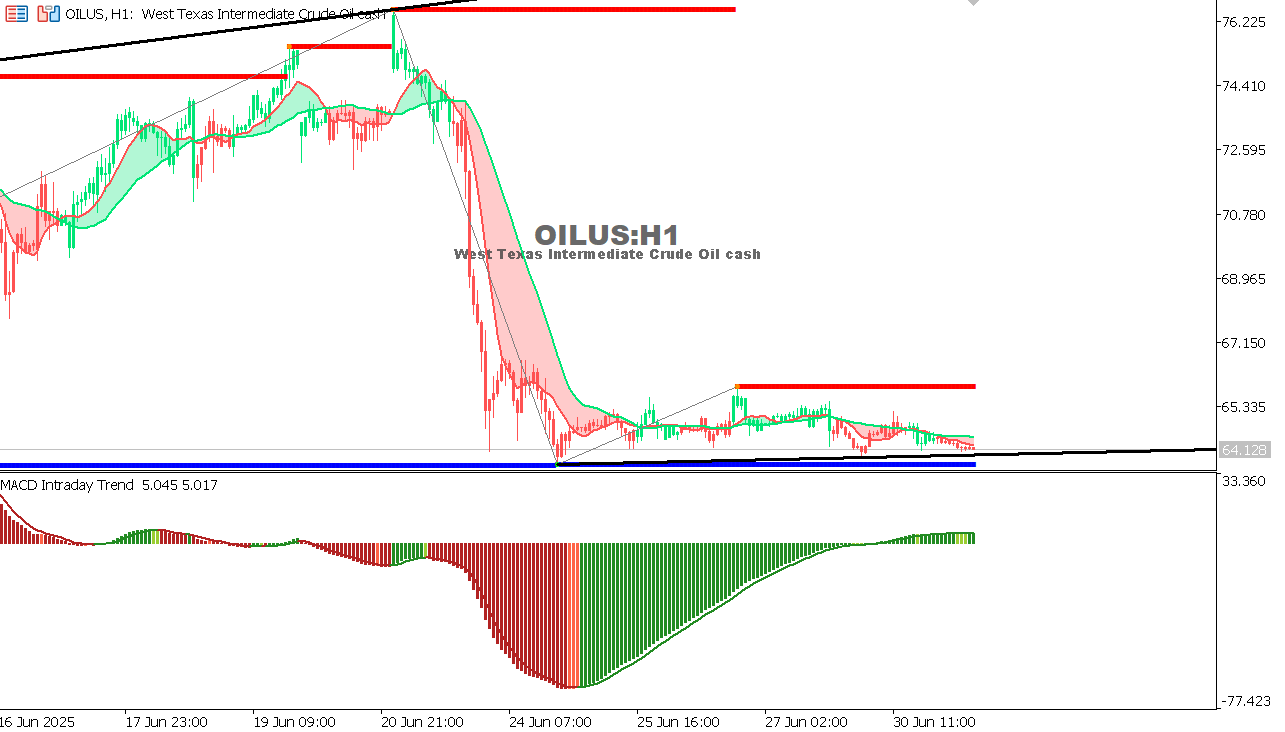

USOIL Chart on the hourtly time frame

Expectations:

|

|

|

|

To access the website's classic version and the new accounts, please click here

Jun 16, 2025

|

|

|

|

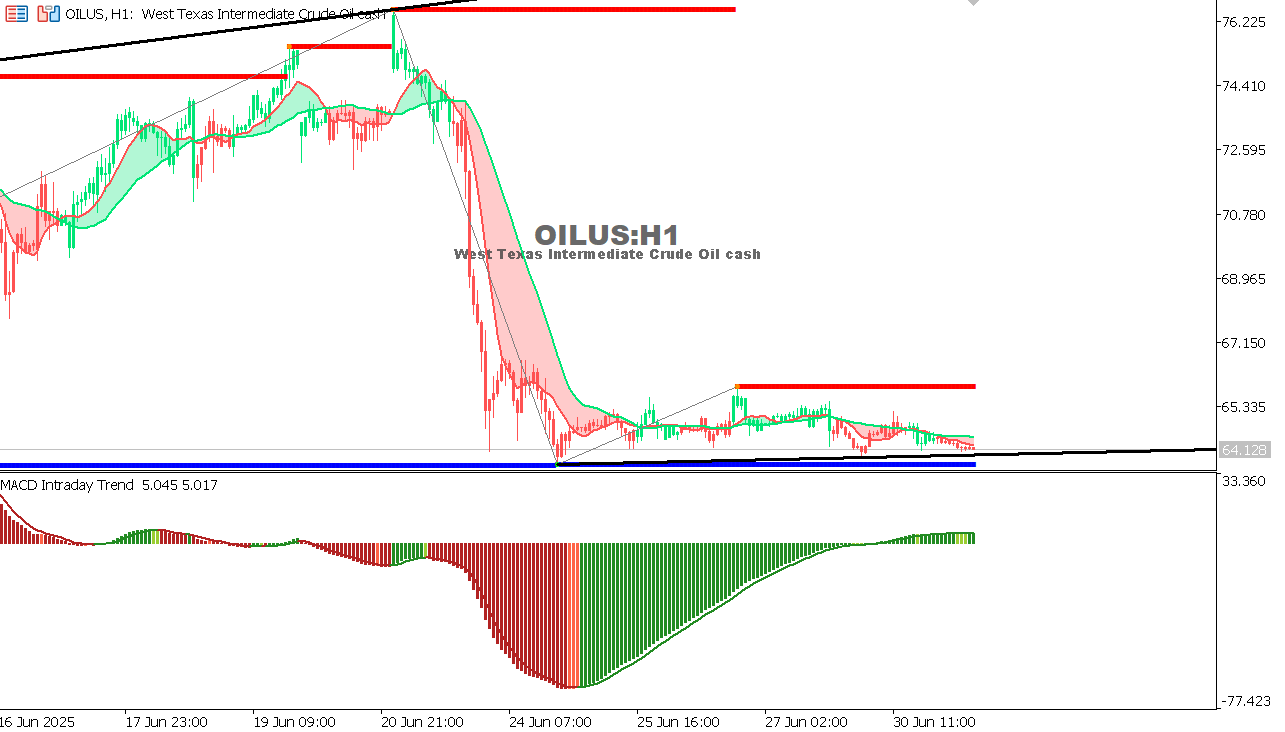

USOIL Chart on the hourtly time frame

Expectations:

|

|

|

|