FXEM - EMPIRE MARKETS - Company New Article

To access the website's classic version and the new accounts, please click here

Jun 13, 2025

|

|

|

|

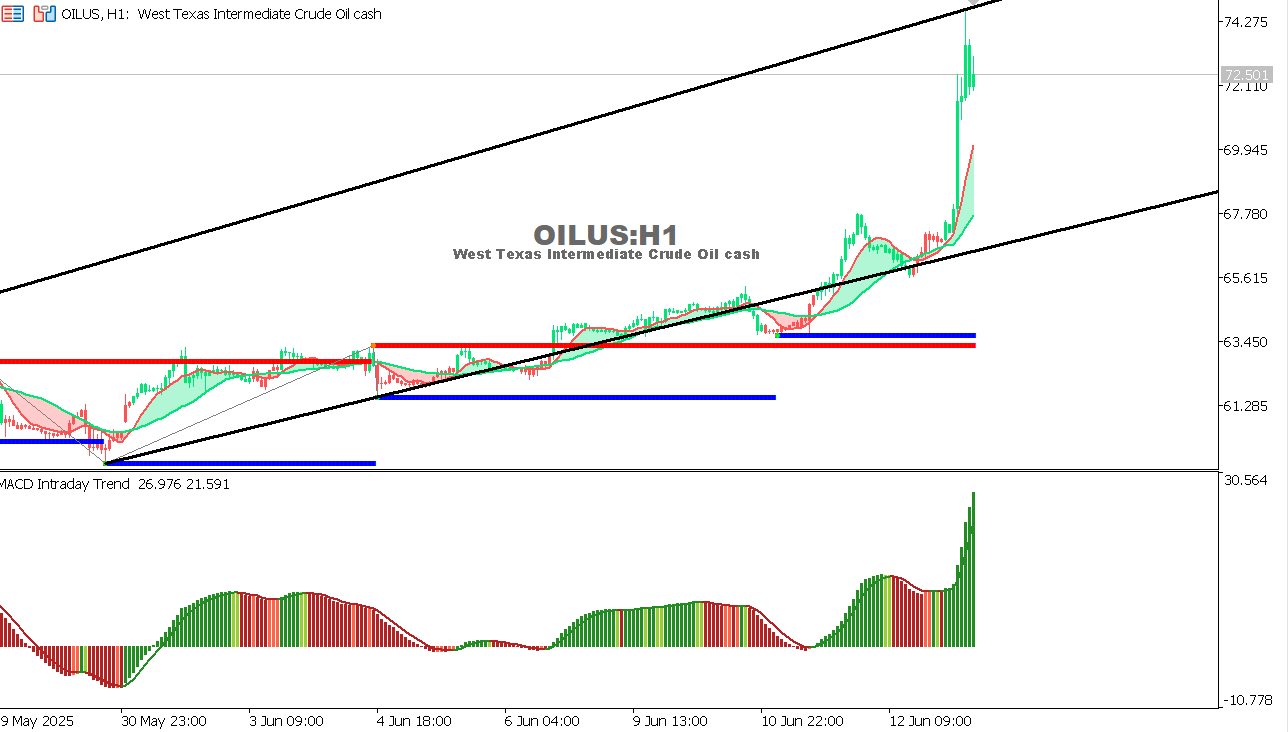

USOIL Chart on the hourtly time frameAs expected yesterday, the price continued rising toward 68.00 — and the target was achieved.

Conclusion:

|

|

|

|