FXEM - EMPIRE MARKETS - Company New Article

To access the website's classic version and the new accounts, please click here

Aug 18, 2025

|

|

|

|

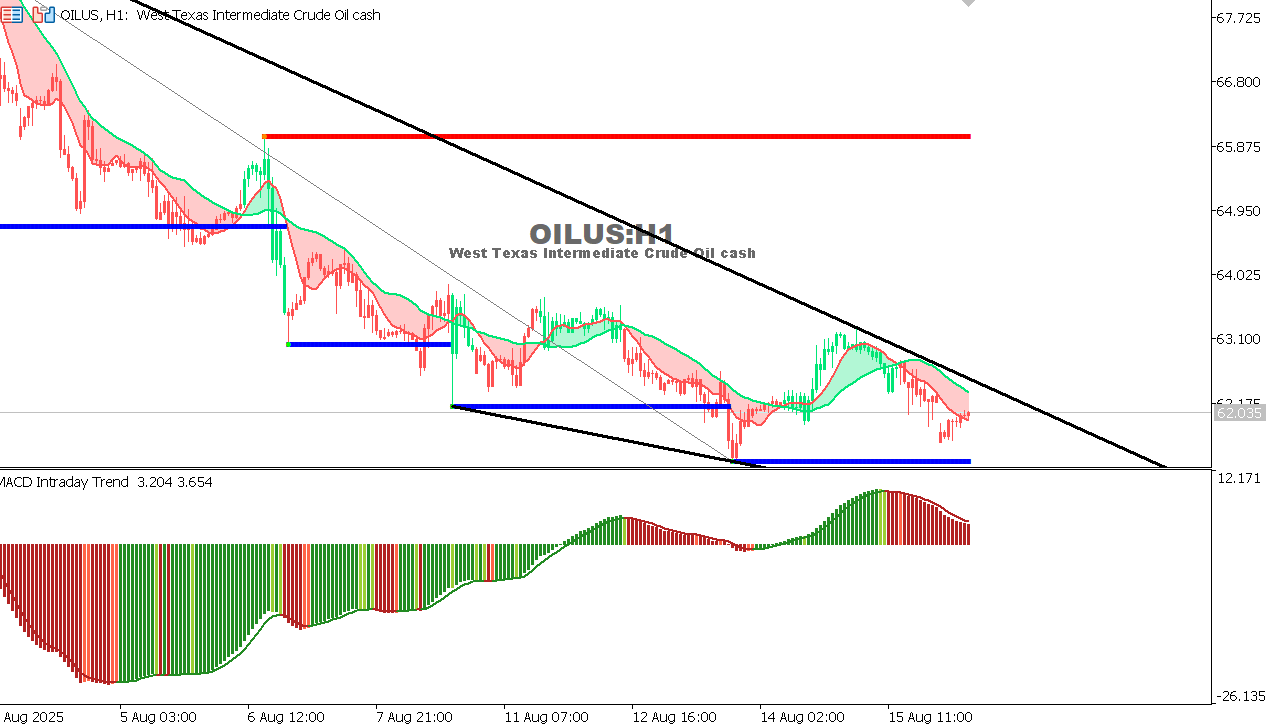

USOIL Chart on the hourtly time frameTechnical Indicator: The MACD shows bearish signals, indicating a possible price decline. Technical Analysis: The price is moving within a downward channel, and a break below 61.95 could lead to further declines towards lower levels. |

|

|

|

|

|

|