FXEM - EMPIRE MARKETS - Company New Article

To access the website's classic version and the new accounts, please click here

Aug 18, 2025

|

|

|

|

||

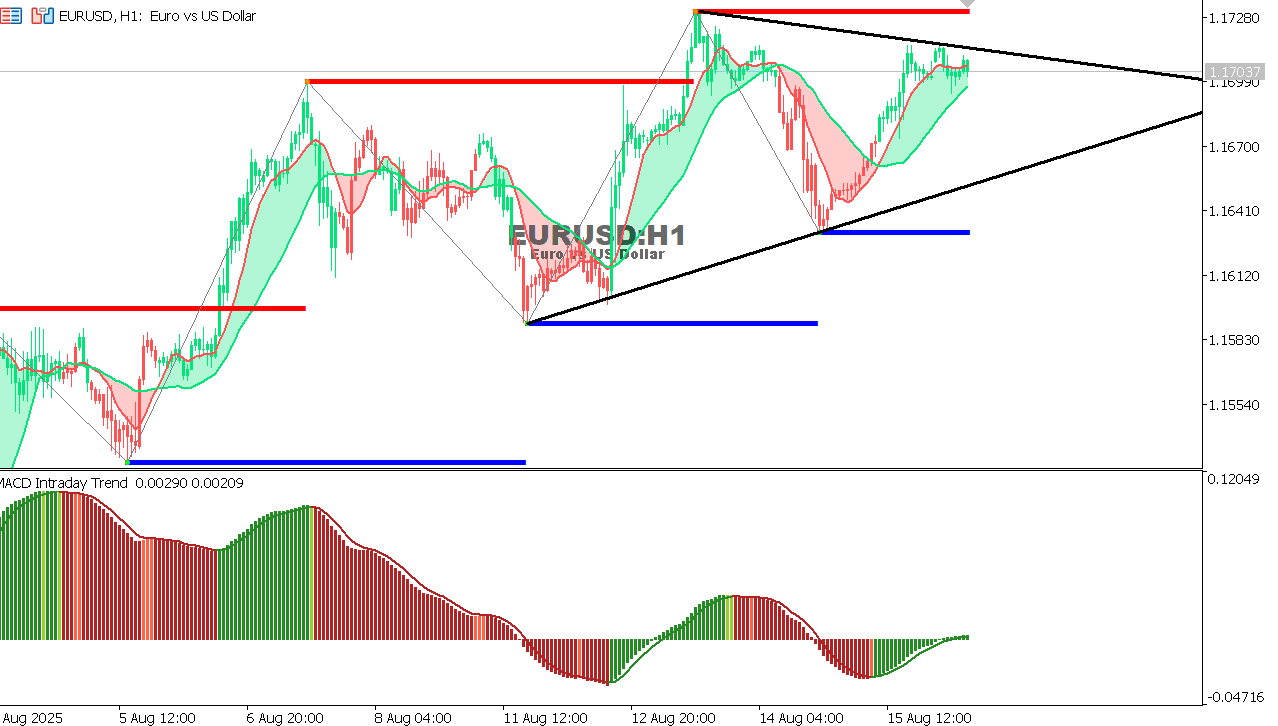

EUR/USD Chart on the hourtly time frameTechnical Indicator: The MACD indicator shows positive momentum, suggesting that the bullish trend could continue. Technical Analysis: The price is moving within an ascending triangle, indicating some consolidation before a potential breakout either upwards or downwards. If the resistance at 1.1728 is broken, the bullish trend could continue. However, if the support at 1.1617 is broken, a larger downward movement is likely.

|