FXEM - EMPIRE MARKETS - Company New Article

To access the website's classic version and the new accounts, please click here

Jun 27, 2025

|

|

|

|

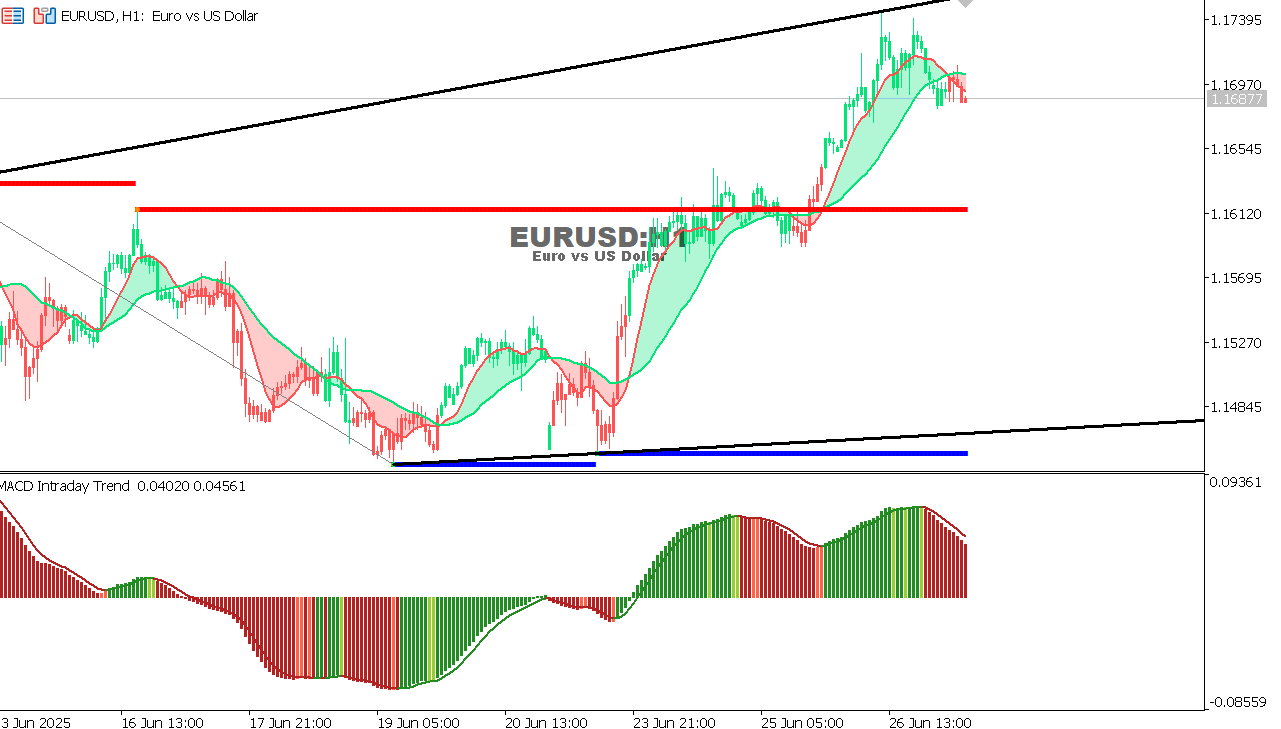

EUR/USD Chart on the hourtly time frameThe first target we mentioned yesterday at 1.1715 was achieved. General trend: Steadily upward The price rebounded from support and rose strongly, but is now experiencing some correction below resistance at approximately 1.1720. Indicators:

Expectation:

|

|

|

|

|

|