FXEM - EMPIRE MARKETS - Company New Article

To access the website's classic version and the new accounts, please click here

Jun 27, 2025

|

|

|

|

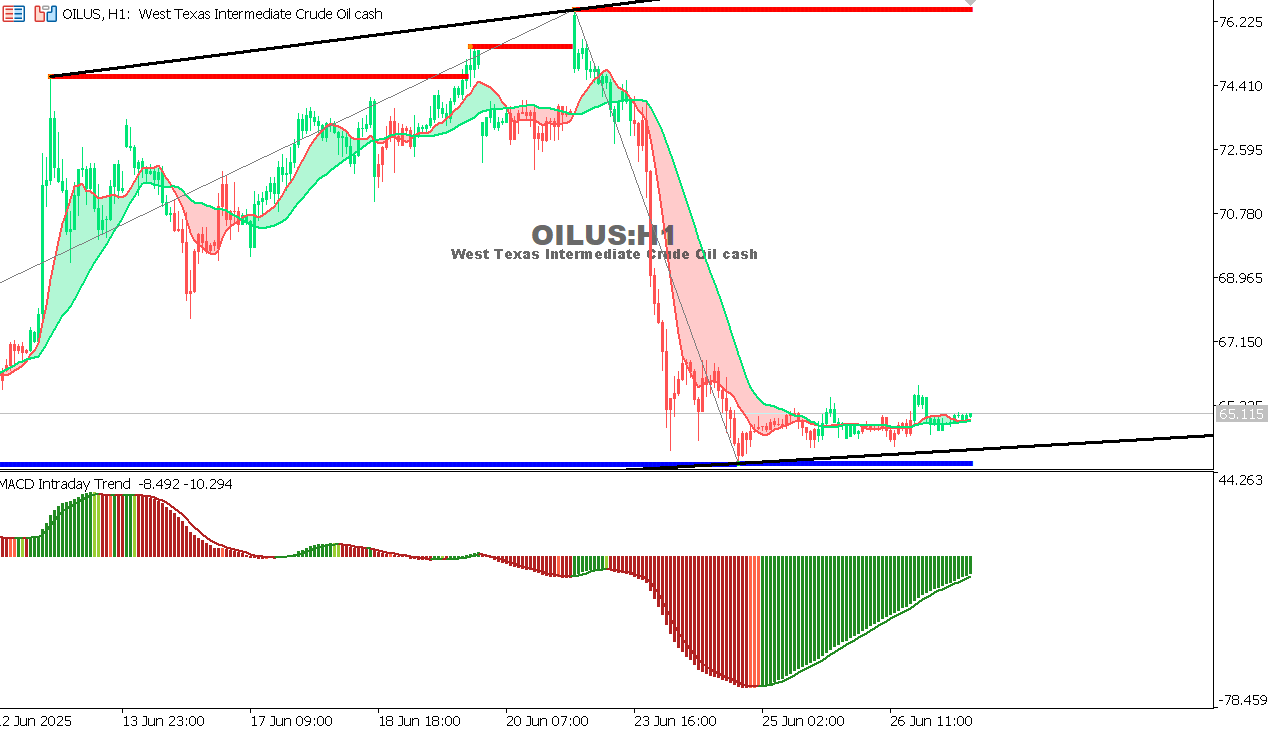

USOIL Chart on the hourtly time frameAs we expected yesterday, the decline will continue towards 63.80 and then 62.50. General trend: Bearish Description: Oil continues trading below the 66 level with clear selling pressure after failing to break the recent resistance. Indicators:

Expectation:

|

|

|

|

|

|

|