FXEM - EMPIRE MARKETS - Company New Article

To access the website's classic version and the new accounts, please click here

Jul 03, 2025

|

|

|

|

||

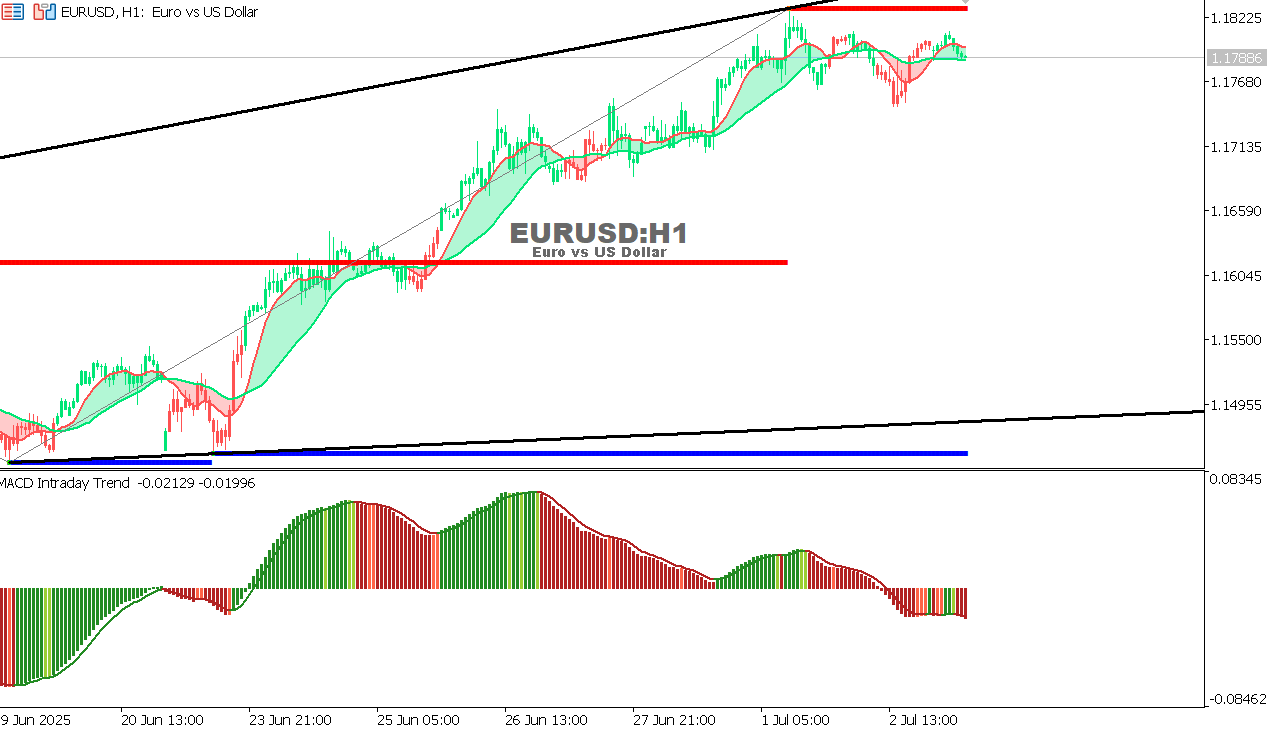

EUR/USD Chart on the hourtly time frameThe price failed to break the strong resistance at 1.1820 and began a clear decline. The MACD indicator shows continued bearish momentum, with weak buying beginning. Trend: Short-term bearish unless 1.1820 is breached Current support: 1.1710 then 1.1600 Resistance: 1.1820 (strong) then 1.1855 Expectation: Continuation of the downward correction towards 1.1710 provided that there is no return above 1.1820

|

|

|