FXEM - EMPIRE MARKETS - Company New Article

To access the website's classic version and the new accounts, please click here

Jul 02, 2025

|

|

|

|

||

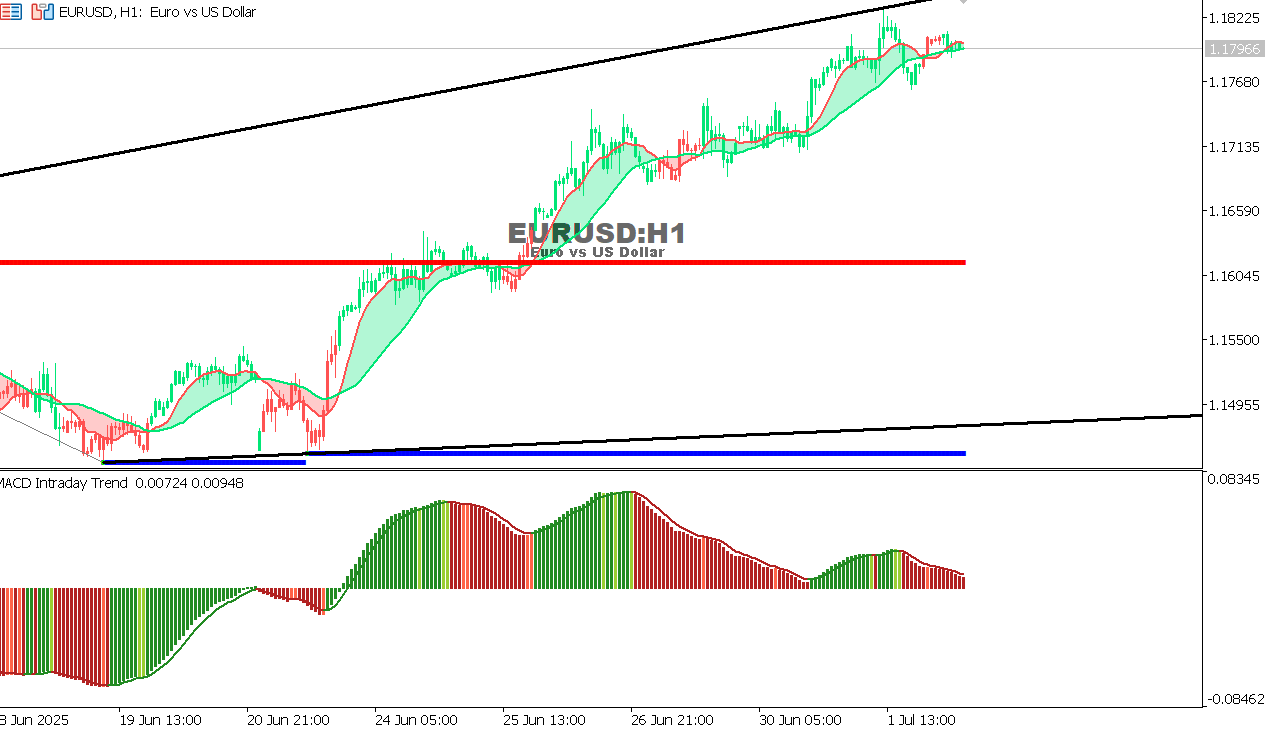

EUR/USD Chart on the hourtly time frameThe EUR/USD pair achieved our target mentioned yesterday at 1.1820. General trend: Upward. Technical situation:

Expectation: A slight downward correction from current levels is possible before continuing upwards if the channel is not broken. Strong support point: 1.1605.

|

|

|