FXEM - EMPIRE MARKETS - Company New Article

To access the website's classic version and the new accounts, please click here

Jun 06, 2025

|

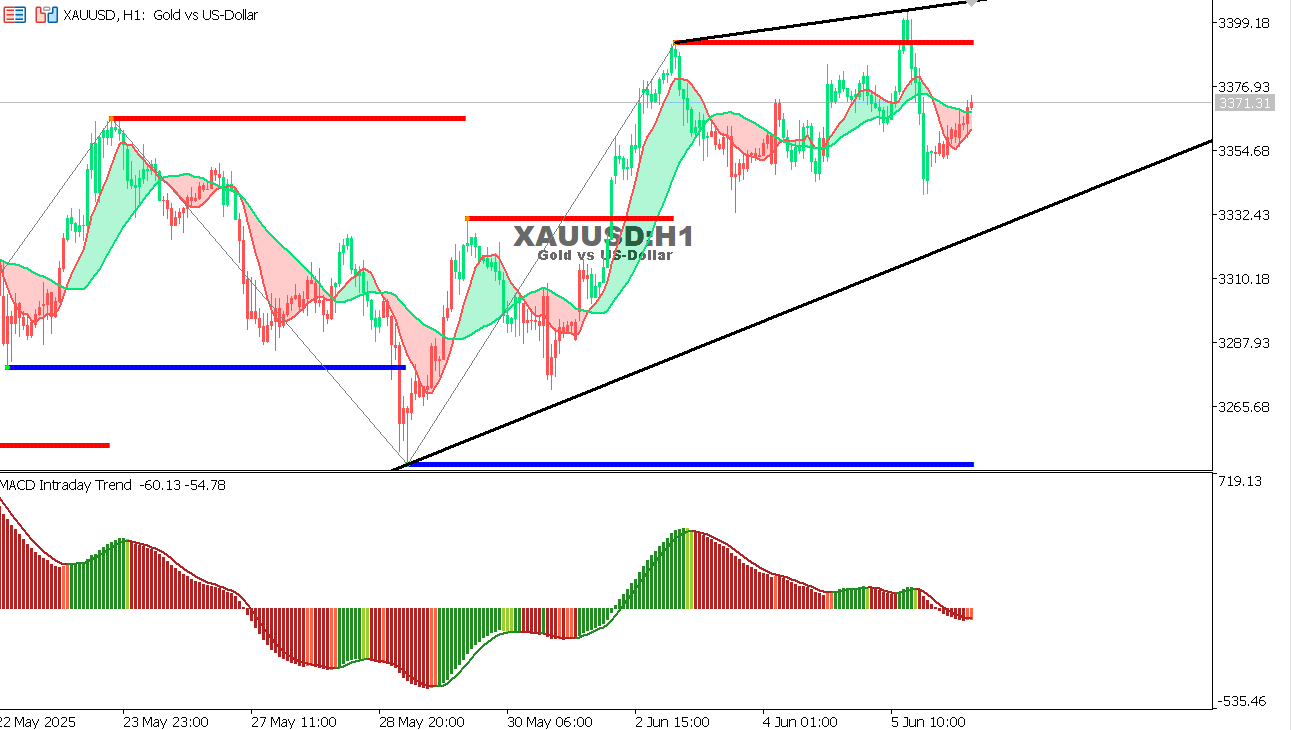

Gold chart on the hourly time frame

Current Technical Outlook:

Outlook:

|

|

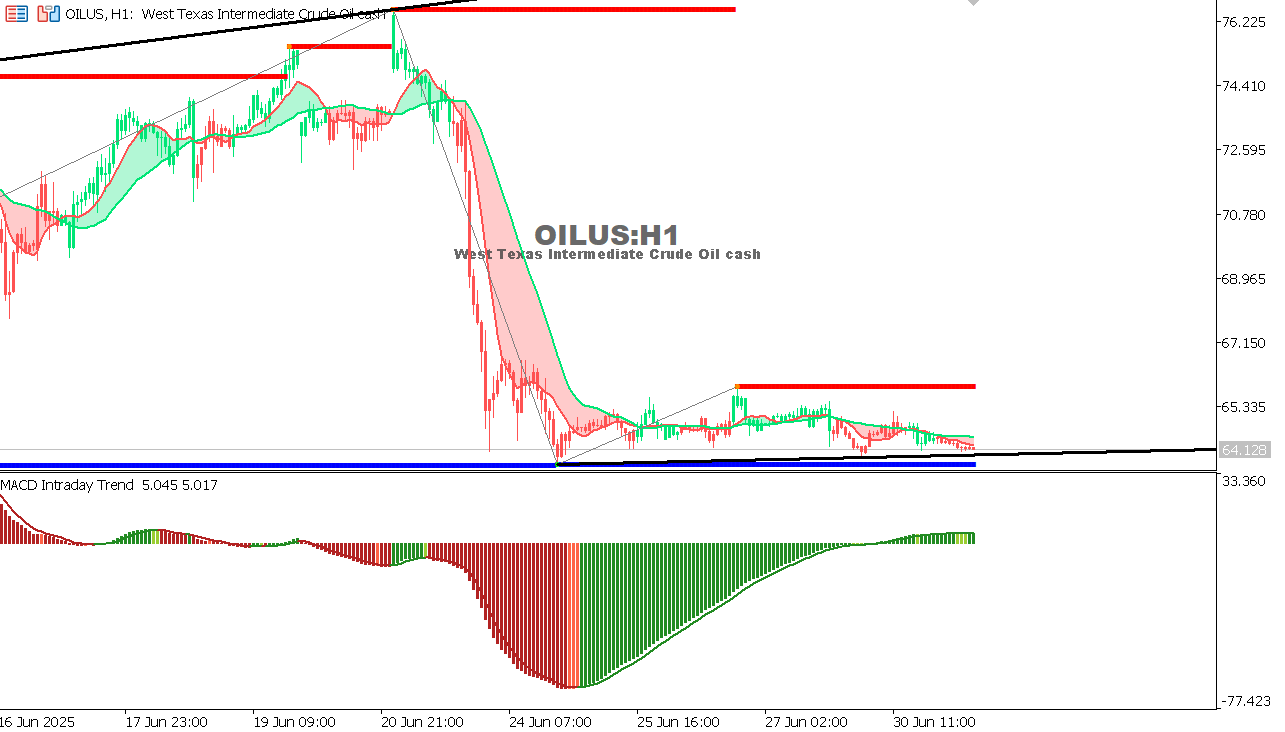

US Oil Chart on the Hourly Time Frame

Current Technical Outlook:

Outlook:

|

|

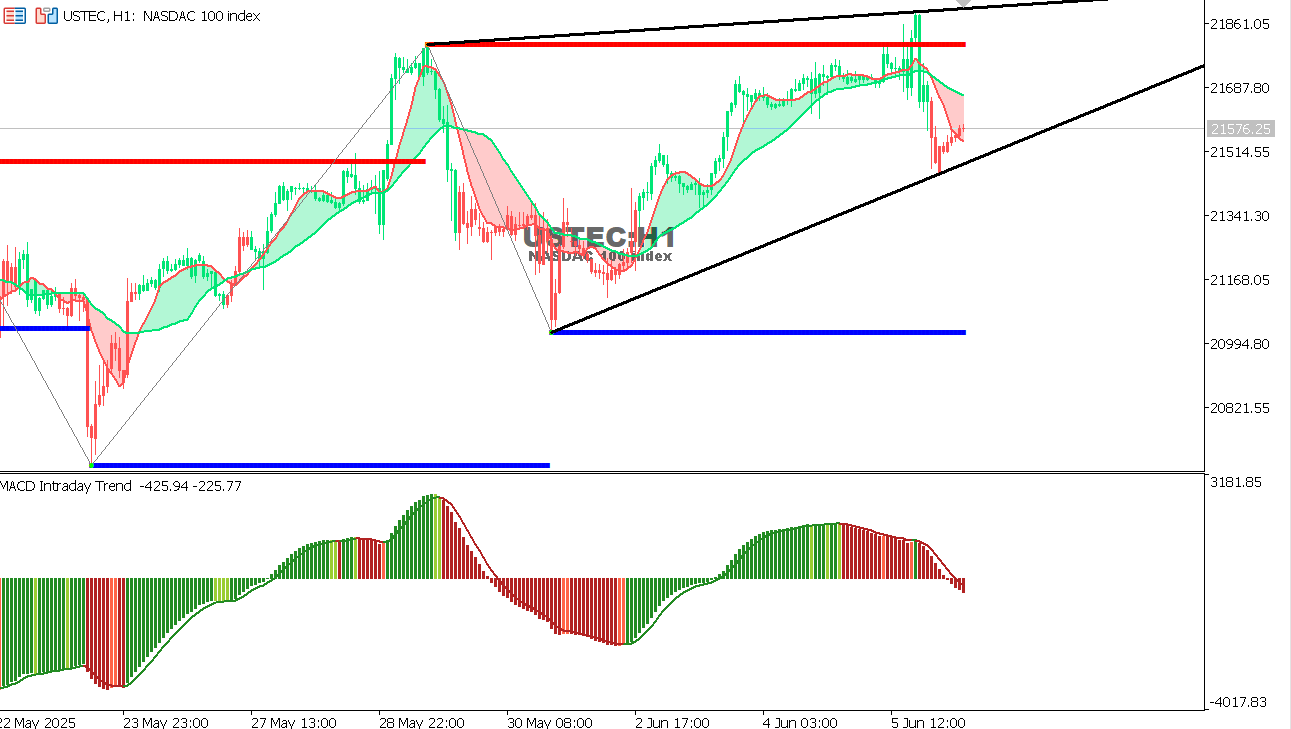

USTEC chart on the hourly time frame

Current Technical Outlook:

Outlook:

|