FXEM - EMPIRE MARKETS - Company New Article

To access the website's classic version and the new accounts, please click here

Jun 30, 2025

|

|

|

|

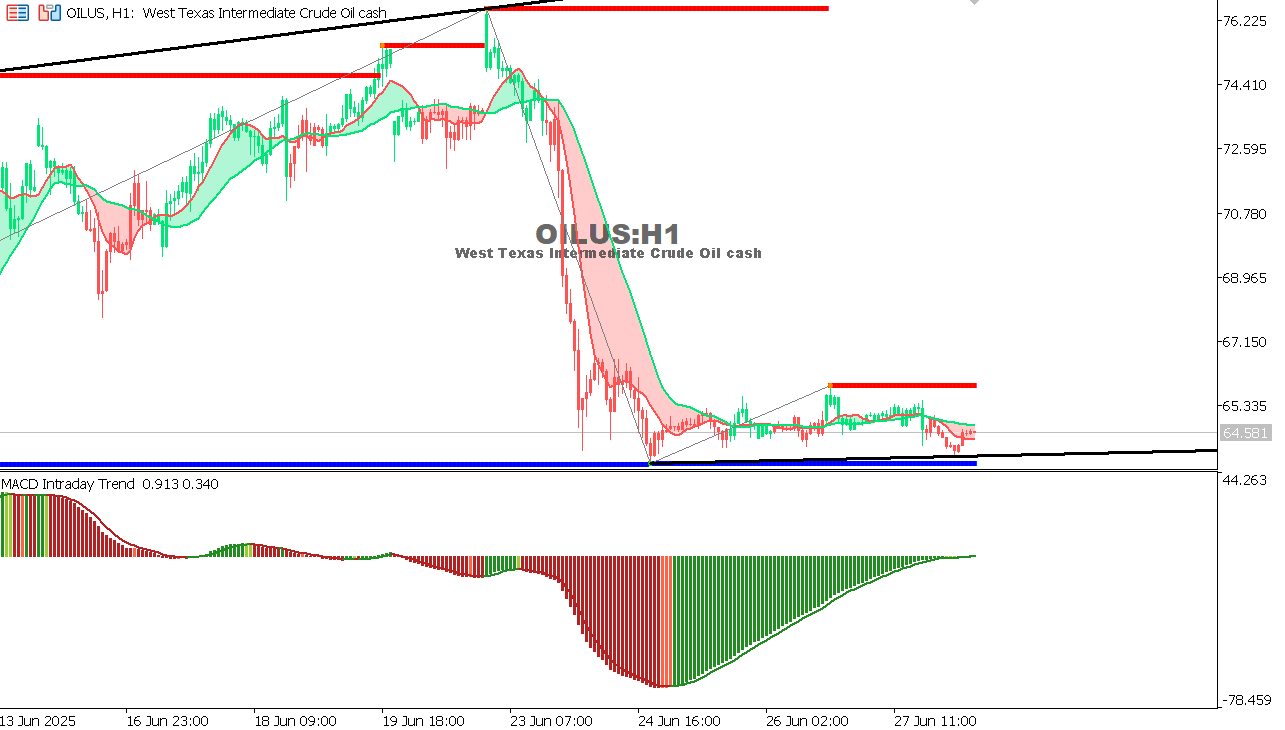

USOIL Chart on the hourtly time frameThe first target at 64.20 has been achieved. General trend: Bearish. Trading continues under pressure, with a failure to surpass the 66.50 resistance. Indicators: MACD is clearly negative, and bearish momentum is dominant. Expectation: The decline will continue towards 63.20 and then 61.80, with resistance at 66.00. |

|

|

|

|

|

|