FXEM - EMPIRE MARKETS - Company New Article

To access the website's classic version and the new accounts, please click here

Aug 12, 2025

|

|

|

|

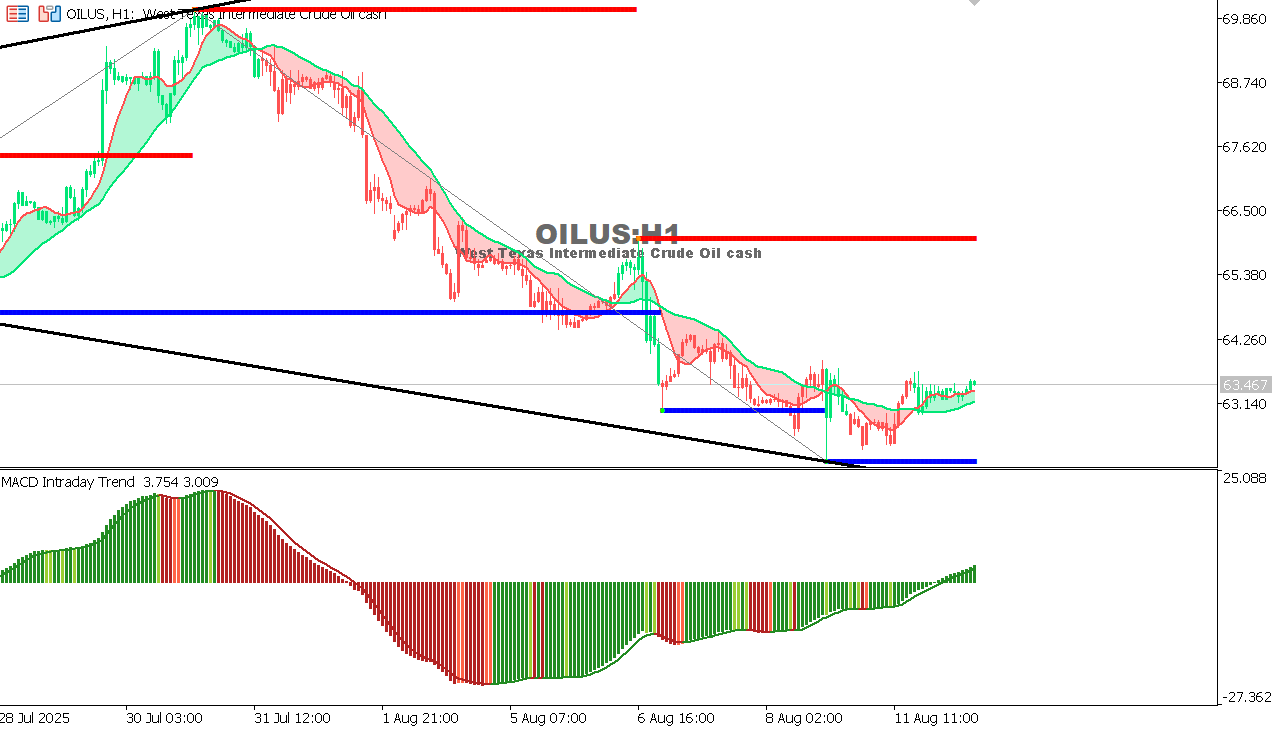

USOIL Chart on the hourtly time frameOverall Trend: Stabilizing near a key support zone. Support: 63.0–63.2 zone. Resistance: Around 65.0. MACD: Slightly bullish but momentum is weak. Outlook: Limited upside potential unless 65.0 is breached. Holding above support may lead to gradual recovery. |

|

|

|

|

|

|