FXEM - EMPIRE MARKETS - Company New Article

To access the website's classic version and the new accounts, please click here

Jun 11, 2025

|

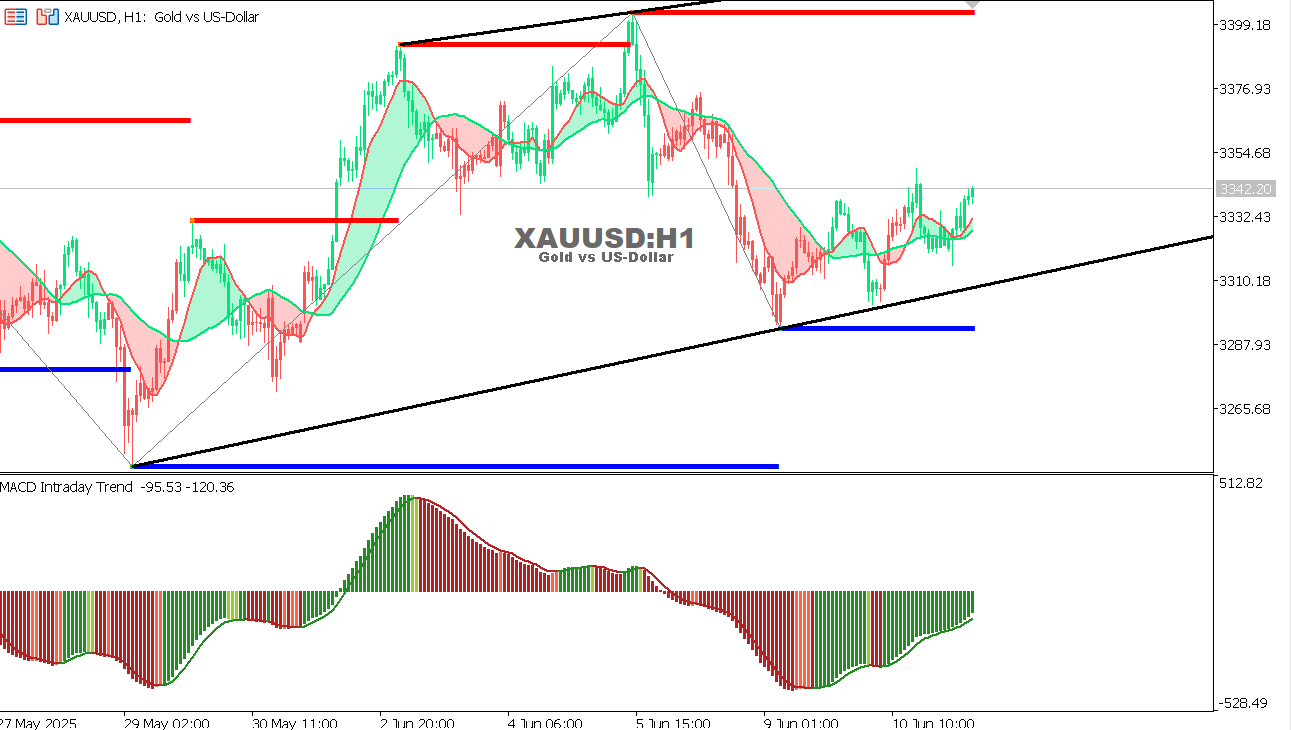

Gold chart on the hourly time frameCompared to the Previous Session:

Conclusion: The bearish scenario played out as expected. Price broke below 3320 and reached 3285. Sustained trading below this level signals further downside risk.

◦ 3270 (first target),

◦ 3340, then 3360. |

|

US Oil Chart on the Hourly Time FrameCompared to the Previous Session:

Current Technical Outlook:

◦ 62.85 (first target),

|

|

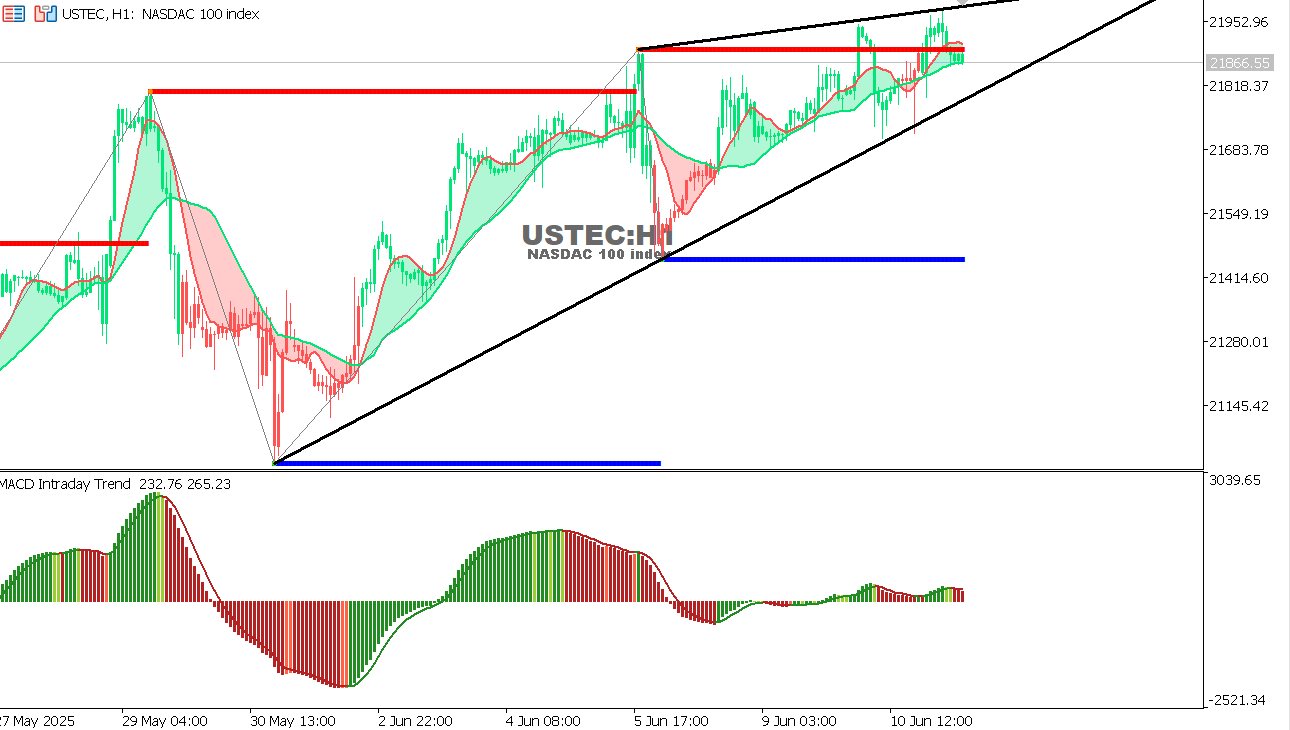

USTEC chart on the hourly time frame

Current Situation:

Forecast:

◦ 21950, then ◦ 22100.

|