FXEM - EMPIRE MARKETS - Company New Article

To access the website's classic version and the new accounts, please click here

Jul 17, 2025

|

|

|

|

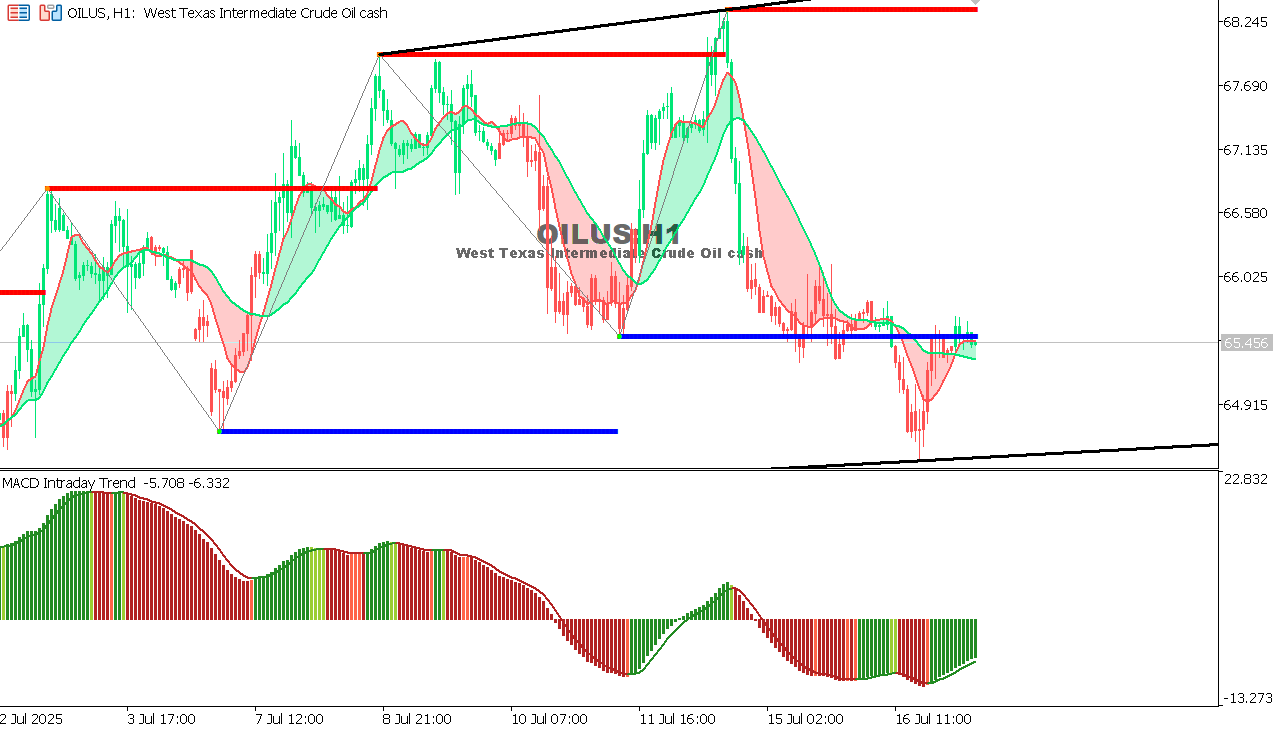

USOIL Chart on the hourtly time frameGeneral trend: Upward in the medium term, but currently in a downward correction.

The price is attempting to consolidate above the support level, showing a rebound supported by the moving averages crossing.

|

|

|

|

|

|

|